Teaching in Economics

The Best of Mankiw

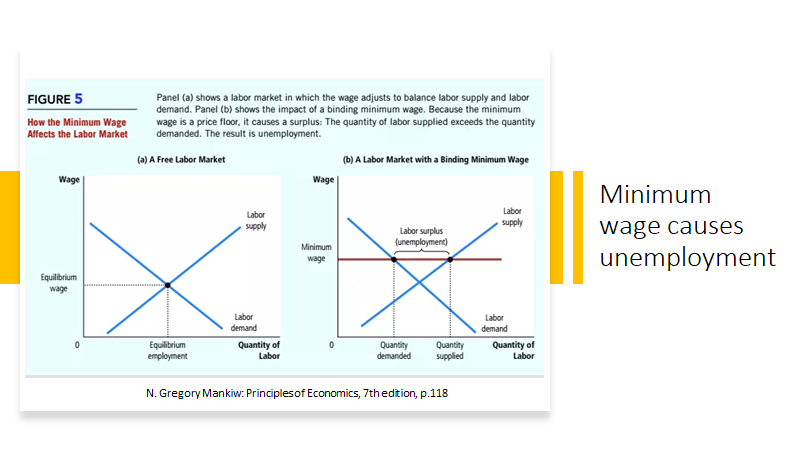

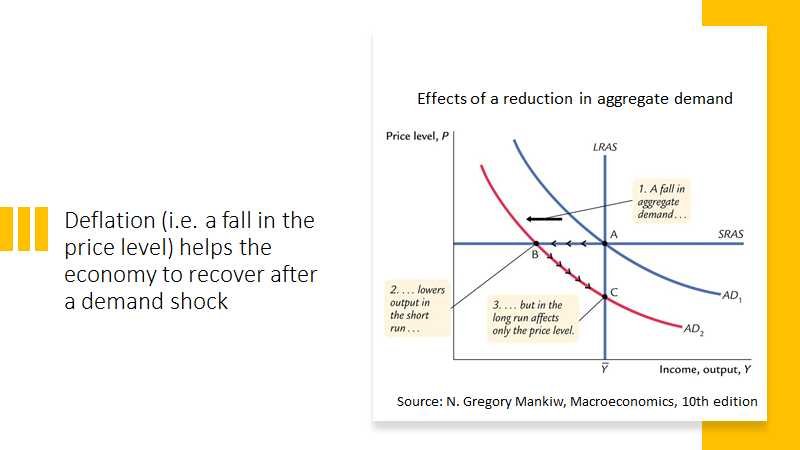

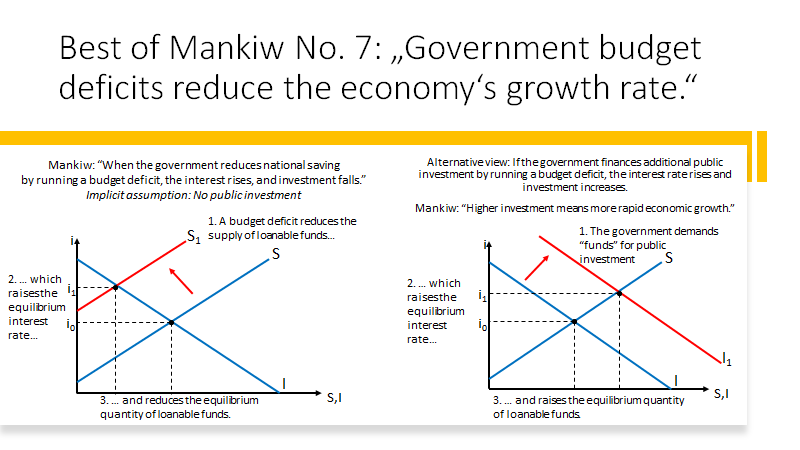

In a series of tweets, Prof. Bofinger points out the weaknesses of the economist N.G. Mankiw's standard works, "The Principles of Economics" and "Macroeconomics".

Click here to go directly to the tweet:

- Best of Mankiw No.1: Please click here to get to the tweet.

- Best of Mankiw No.2: Please click here to get to the tweet.

- Best of Mankiw No.3: Please click here to get to the tweet.

- Best of Mankiw No.4: Please click here to get to the tweet.

- Best of Mankiw No.5: Please click here to get to the tweet.

- Best of Mankiw No.6: Please click here to get to the tweet.

- Best of Mankiw No.7: Please click here to get to the tweet.

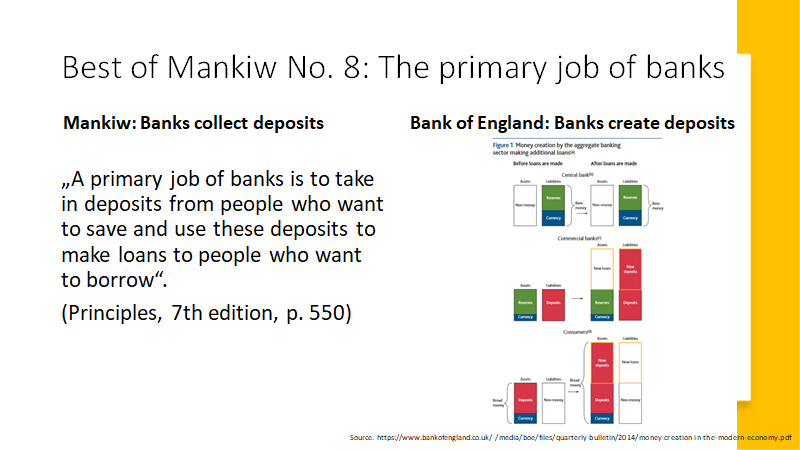

- Best of Mankiw No.8: Please click here to get to the tweet.

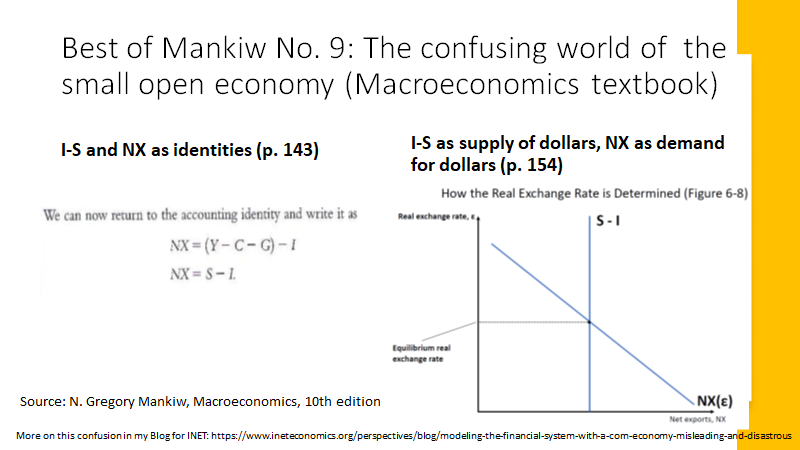

- Best of Mankiw No.9: Please click here to get to the tweet.

- Best of Mankiw No.10: Please click here to get to the tweet.

In an article for the "Institute for New Economic Thinking (INET)", Prof. Bofinger explains his tweet series "The Best of Mankiw" and goes into the numerous errors and confusions of the standard works of economic education: Please, click here to read the article.

In a discussion organized by "Forum New Economy" and moderated by Thomas Fricke, Prof. Bofinger discussed his criticism directly with Prof. Mankiw. Anna Reisch (Netzwerk Plurale Ökonomik) and Prof. Bachmann (University of Notre Dame) also took part in the discussion: Please click here to see the discussion as video.

More information and links on "Teaching in Economics"

Fundamentals of Economics: An Introduction to the Science of Markets

Book by Prof. Bofinger (only available in German ); The economic thinking conveyed in the book is not only important for students of business administration and economics. It helps people who are interested in economic policy to understand the discussions on economic issues and to form their own judgement. Link

Core Project

To help teachers for delivering asynchronous teaching, the "Core Econ" Project offers a variety of resources and some guidance. Click here to go to the core project

Lecture by Prof. Bofinger at Plural Economics

The conference will discuss the status quo in economics and new perspectives in research and teaching.Video

Teaching macroeconomics after the crisis

Working paper from Prof. Bofinger. Würzburg economic papers, No. 86 (2011) PDF

More detailed information on Prof. Bofinger's criticism of modelling the financial system with a corn economy

- Click here to go to his article on INET "Modeling the Financial System with a Corn Economy – “misleading and disastrous”"

- Click here to read his article: "Reviving Keynesianism: the modelling of the financial system makes the difference."

- Click here to read his article: Fridays for Keynesianism.

BMW Papers in Journal Economic Education

- The BMW model: a new framework for teaching monetary macroeconomics in closed and open economies

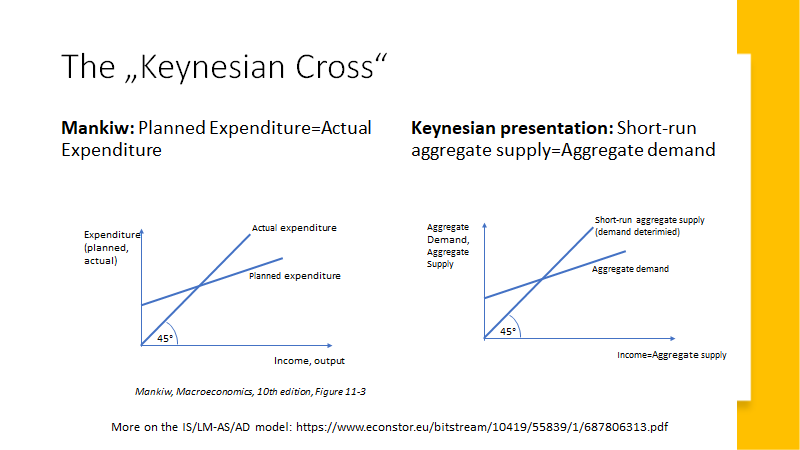

- The BMW model: simple macroeconomics for closed and open economies – a requiem for the IS/LM-AS/AD and the Mundell-Fleming model

- The BMW model as a static approximation of a forwardlooking New Keynesian macroeconomic model